Next year promises unpredictable economies and potentially unsavory performance. Both of which mean sound business fundamentals and cash management are on everyone’s mind.

What better time to think about getting your business in order than when creating the budget for the year ahead?

Keep in mind that a budget is a list of predicted expenses. Meaning, the better idea you have before setting the budget, the more accurate it’s likely to be. So, instead of a typical “how much did you spend last year?” business budgeting blog — we’re showing how to ensure your budget is an asset to running your business.

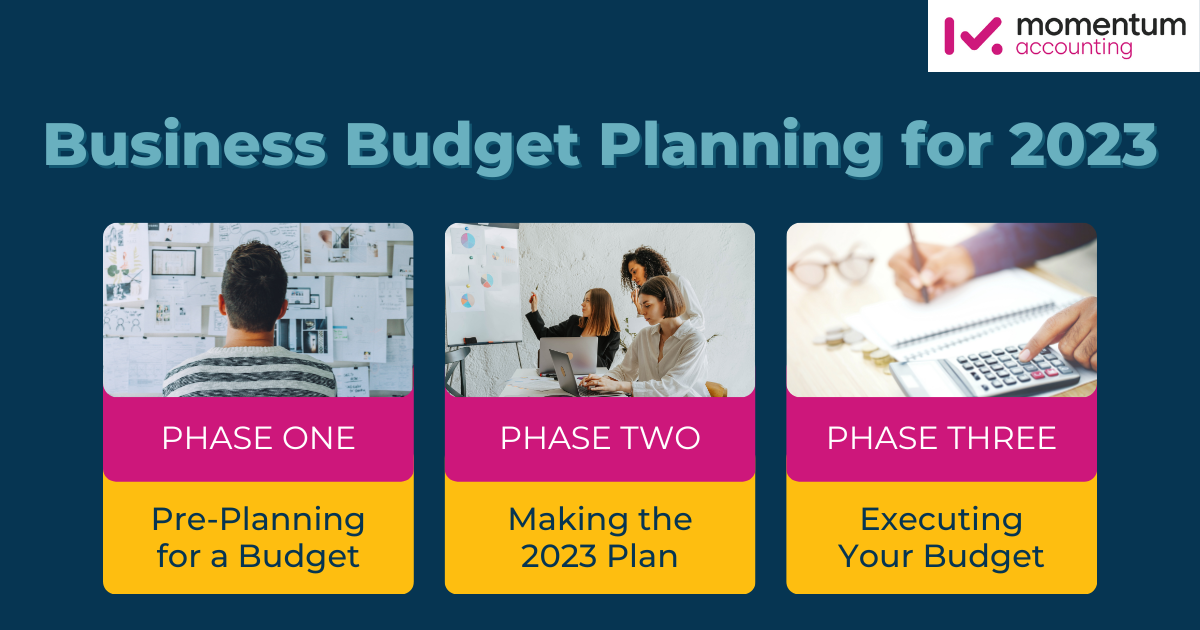

Let’s go over the three big phases of business budget planning.

Phase One: Pre-Planning for a Budget

The first step, before you set next year’s spending, is to understand your numbers. Without a firm grasp of things like:

- Income: You probably know how much revenue’s coming in, but has it slowed down versus the same period a year ago? Two years ago? How are your sales channels performing?

- Outgoing: Again, most business owners have a general idea the business is bringing in more than it’s spending, but when’s the last time you took a good look at your P&L, to get a granular understanding of where your money goes?

- Team: Take a look at your workflow, output, and each individual on your team. Who’s key? Who’s underperforming? Who’s due for a raise? Who will you need to hire if you meet your revenue goals?

- Clients/customers: If you’re in a service-based industry (i.e. agency/consultant), who’s shaky? Contracts ending? What’s in the pipeline?

Before you talk about spending, or forecasting revenue, you must feel confident you know where the business stands. To be clear, whether you feel good or bad about current performance is irrelevant. It’s all about getting a solid footing — before you make a budget.

Phase Two: Making the 2023 Plan

Yes, phase two is where you actually set the spending for the upcoming year, preferably based on predicted performance (aka, a forecast). But budgeting for an economically opaque year takes more than knowing how much to allot for your software subscriptions and snacks for the team.

It’s here you’ll really love knowing and having an in-depth picture of your business.

For example, knowing your income sources and sales channels may show:

- Softening channels that provoke you to find new sources for clients, or even new streams of income. It’s also time to sure up that accounts receivable process to ensure cash flows into the business in a timely manner.

- Notice places where your ad budget is working surprisingly well, and you can double down, to increase in a time where others are tightening.

Maybe it’s your team?

- Who’s your next hire, if you’re able to find sales channels or additional revenue streams in a downturn? Who’s the first layoff, should it come to it?

Speaking of finding new clients:

- Sometimes clients leave. That said, you can strengthen your relationships by improving connections, better conveying results and deliverables, and setting clear expectations.

- When others are focusing on tightening the expenses, see where you’re able to differentiate and deliver for clients no matter what comes in 2023.

A Word on Scenario Budgeting

A clear picture of performance and financial records is key to a successful budget. Much like a good forecast, your budget should include various scenarios.

What happens if things go as well as hoped (or better)?

Or if the business stays the course and performs as expected?

And, what if things go worse than hoped?

These are the three typical scenarios used in forecasting, and provide a helpful template for your budget. You don’t have to do your budget three times, but it’s good to get the expected budget ready and to know:

- Where any additional spending goes (if things move toward the positive): New hires, new equipment, new contractors, etc.

- A couple stages of potential contraction (in a down spot of performance): A moderate and severe plan would help set your mind at ease.

Think of scenario planning like stress-testing your business. Make a budget, and ask yourself —What would happen if our next quarter earnings dropped 25%? As much as 50%?

- Note: Conversely, ask yourself about positive increases, too. Growth is often stressful on businesses.

Phase Three: Executing Your Budget

When the budget’s done, it’s reassuring. A sign of relief. But be careful, and don’t just check it off of your to-do list.

Use it.

Regularly review it, see where it’s accurate and inaccurate. When things go better (or worse), use the plans that came with your budget planning to better weather problems and take advantage of opportunities.

Ready for 2023’s Business Budget Planning?

This is a slightly different approach to budgeting than you’ve seen before. At Momentum, our approach to accounting is different, taking into account all aspects of your business.

Why? Because everything ties back to your financial performance.

If you’d like to see how we help businesses like yours with budgeting and setting up sound financial systems — get in touch today.