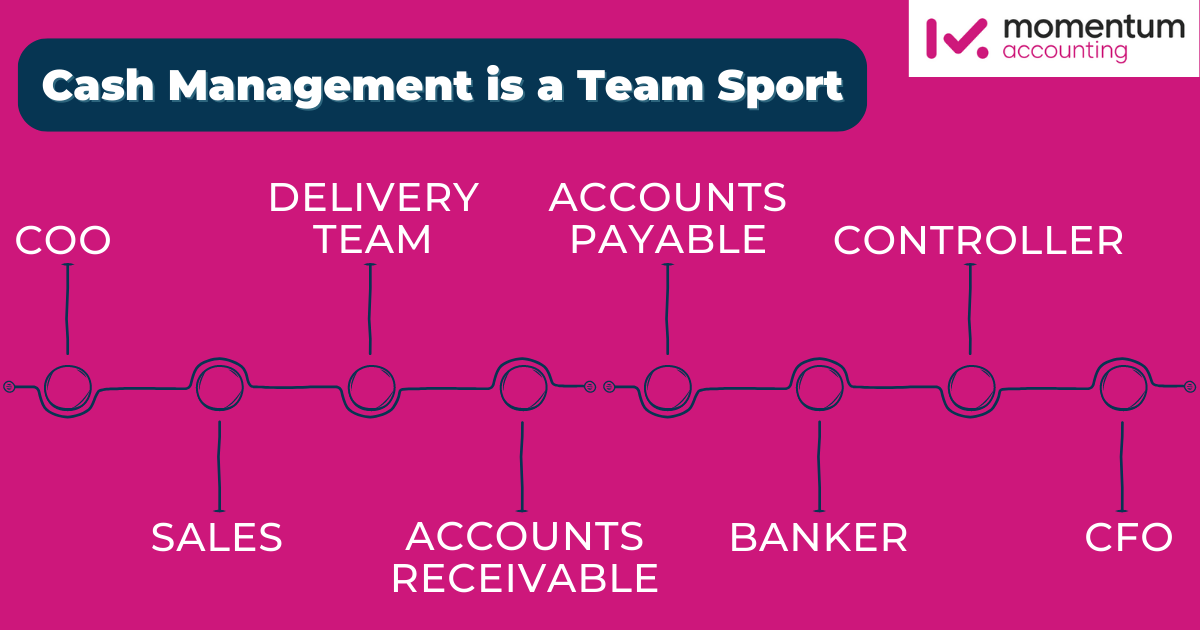

Did you know…. cash management is a TEAM sport? Your entire cash management system, or ecosystem really, includes:

- All departments of your operation (aka the people)

- The tools you use to manage cash

- The system and/or infrastructure you use to ensure things run smoothly

In this article, we’ll look at the importance of cash management systems, how every part of the team contributes, and how to optimize the cash system in your business for optimal performance.

Quick, Yet Deep Dive into Cash Management

A cash management system includes the tools, processes, and policies you use to handle cash from one end of the business to the other. If money comes in or out, it’s part of your system. But how well you manage it matters.

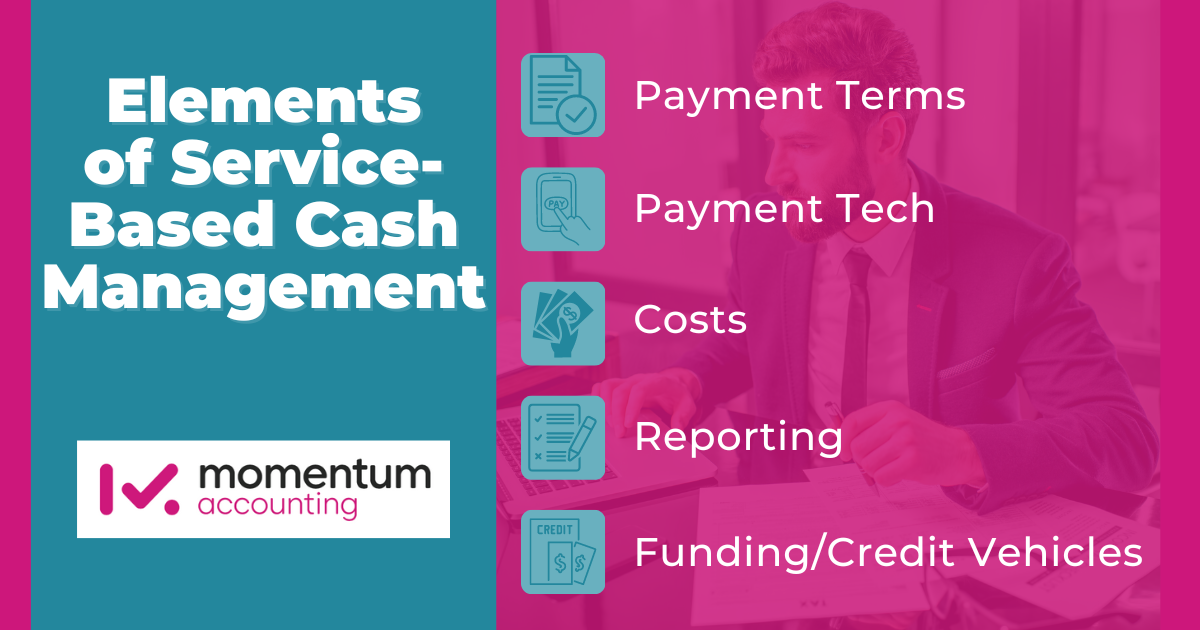

Elements of a service-based cash management system include:

- Payment terms: How your business brings in revenue (aka how clients pay for your services).

- Payment tech: Software you use to manage incoming/outgoing payments, budget, do forecasts, and so on. The tools you use to manage cash.

- Costs: For service-based businesses, like agencies, these are things like paying contractors, software subscriptions, accounting services, etc..

- Reporting: Compiling the money coming in and going out into readable, usable financial reports. (Items here include P&L, cash flow statements, and so on.)

- Funding/credit vehicles: The best system allows cash to flow with minimal need for interest-bearing funding, but lines of credit and CCs are a part of most businesses’ cash management.

Here’s How Cash Management is a Team Sport

Depending on the size and complexity of your operation, one person may have more than one of these described roles — and that’s perfectly ok. Don’t think that just because you have one person handling a couple of things, you can’t ensure these things work.

Now, let’s look at a service business where cash is optimized…..

Sales

Sales is the first line of revenue generation. Generally, they should understand two aspects of the business:

- How long things take to deliver, and what goes into each service you offer. Sales paints the picture of what your business does for clients (what’s in it for them), with a good idea of what it takes to create that reality.

- Payment structure hierarchy. In an ideal system, sales negotiates payment terms with customers. Prepayment terms are ideal for cash flow. This should be your primary method, to get ACH payments set up by the sales team for new clients. Then, invoicing with Net 30 terms, and so on. All likely based on the value of the client.

COO

Systems are a set way of how things happen, a process. And operations are the regular actions of a process. The role of the COO makes sure the tech, standard operating procedures (SOPs), and team are in place to execute cash management (among other things).

Specifically for the financial aspect, the COO of an optimized system ensures:

- Customers can pay electronically, either by ACH or invoice (remember ideally sales is setting up prepayment and ACH to improve cash flow, but the tech has to be there to take client info).

- Tools/processes are in place so data gets to AR quickly after services have been performed (in the event you invoice clients once work is completed).

The COO also negotiates favorable payment terms with vendors during the purchasing process.

Example: You have a whale client (like a Fortune 100) for your agency. BUT…they’re Net 90 terms. You’ll have to provide 5 or 6-figures of service before you see any revenue.

A COO negotiates with vendors to ensure things run smoothly until that 90 days is up. For instance, they set meetings with all contractors who’ll work on the project, explain the situation, and see if the contractor will work on augmented terms.

- Take 20% down and the remaining upon payment from client

- Wait for the fee, but have a 10% addition for the trouble

NOTE: The COO doesn’t do this negotiation in a bubble. As we’ll see, the CFO could help determine financing options (e.g. a line of credit). Or, sales could bring in the COO or the owner to negotiate with the client for a percentage of the fee in advance (example, asking for 20% upfront, another 30% halfway, and the remainder upon completion).

Accounts receivable (AR)

Fairly standard role here, but if the COO has the system rolling, AR makes sure invoices are sent out immediately after services have been performed. This role also follows up with clients to ensure timely payments and keeps track of customers who are overdue.

Delivery team

What does the delivery team do for cash management? You protect your proprietary assets — the minds of your team.

In service-based business, your output is often “knowledge work.” Meaning, coming up with that ad campaign, writing incredible copy, or developing entire campaigns that help your clients achieve their goals.

If your delivery team doesn’t clearly understand the scope of the project, including expected time, turnaround, and results — you’ll run the risk of “giving away” free knowledge work that can’t be billed.

Scope creep is a real thing and quickly cuts into margins. Not to mention, extend the time until you bill (if you don’t negotiate prepayment).

Accounts Payable (AP)

Look, finding good contractors or vendors is so important. Inversely, scrambling to find new partnerships often costs time and money. Time because good contractors are hard to find and it takes some digging.

Money because what happens if the new contractor gets the assignment wrong, needing multiple revisions. Even if the new partnership is a good one — it takes time to get in sync.

The point?

AP is vital to maintaining good relationships with vendors and helps in negotiating payment plans (with the COO) if needed. Plus, AP knows to pay the most critical bills first. For instance, if you’re an SEO agency, tier one is likely something like: payroll > Ahrefs > internet.

Controller

Controllers prepare financial reports that tell the story of how the business is operating.

This role oversees AP, AR and payroll. Their reports show how well you’re protecting your delivery team from scope creep, how quickly you’re getting paid by clients, and how well you’re fulfilling your obligations to your vendors/bills/contractors.

NOTE: These reports include data like cash flow statements, P&Ls, budgets, etc..

Banker

A line of credit requires a banker. The banker works with your business to keep an active line of credit.

A good relationship with your banker is critical.

What happens when your agency service multiple $5 to $10 million dollar businesses suddenly catches the attention of a whale client? You need infrastructure, tools, and people to deliver. Oftentimes, it can’t be done without the liquidity provided by a line of credit.

CFO

A CFO (either full-time, fractional, or virtual) quarterbacks the entire cash management system.

Working hand-in-hand with the owner and COO, a CFO anticipates future cash shortages, increases in demand, problems seen within the reporting data — and adjusts things accordingly 🏈

After all, even healthy and profitable companies encounter cash flow problems or seemingly unexplainable hiccups. Having the right systems, team, and technology in place is essential.

Ready to Up Your Game?

Momentum specializes in implementing cash management systems — including the tools, payment method setup, reporting, and CFO advisory.

Take a look at a few of our clients’ success stories, or reach out and see how we can help you build a system that helps your business achieve momentum.