Give your digital marketing agency a competitive advantage.

Momentum Outsourced Accounting Services.

If you own or run a digital marketing agency, you’re always trying to find an edge. We’re it.

We know the agency business.

We built our accounting solutions specifically for digital agencies. We help you address new workplace realities – remote, multi-state employees, cloud-based – with highly automated, streamlined digitalized accounting operations.

We can help you determine profitability for monthly retainers, project work, media spend and commissions. Our invoicing solutions help you get paid faster. And the best part is that accounting and all of the related processes that come with it, are gone.

We provide financial insight and guidance through our monthly reporting. It’s like having a CFO, controller, bookkeeper and payroll expert on your team…without the salaries and overhead!

We help you flip the script on cash flow.

Most agencies push invoices out and wait to get paid. In fact, depending on the size of the agency and the clients they deal with, the average wait to get paid ranges from more than a month to up to 52 days!

If that sounds familiar, it’s an enormous strain on your cash flow and a drag on productivity. One of the biggest complaints we hear from agency owners is that they HATE dealing with invoicing and chasing past-due customers. It’s a time sponge and nuisance.

If it is poorly managed, you can end up with thousands or even millions of dollars tied up in accounts receivables.

We show you how to get paid first and fast.

With today’s cloud-based tools for accounting, invoicing, and payment processing, we will help you automate the invoicing and collections process and virtually eliminate issues with receivables.

The result is a more predictable and steady cash flow. And, you no longer have to waste your valuable time on receivables, and can instead focus on activities that grow your business and strengthen client relationships.

Here are a few signs that your company has cash flow issues due to ineffective invoicing and collection processes:

1. Payroll issues.

You sometimes have to contribute money to the company or draw on a line of credit because you don’t have enough to cover payroll, even though your business is profitable on an annual basis. This should be a serious wake up call.

2. Surprises in your P&L’s.

The company’s profit and loss statement is “lumpy”; meaning the net profit takes big swings each month and it’s always a surprise. No one likes surprises, especially financial ones.

3. No profit insight.

When you look at your P&L, all your revenue is consolidated into one line item, so you have no insight into which clients and services are most profitable. Because of this, it’s hard to know how the company is performing and it’s difficult to compare the agency’s metrics against industry benchmarks.

4. Too many systems.

When it comes to knowing who owes the company money, there is no one source of truth. For example, you may be using one system for invoicing and collecting payments, and a different system for entering your bank data and reporting. Your AR aging may not match in each system and that can lead to lost revenue. Even worse, you sometimes follow up with clients, only to find out they’ve already paid.

5. A need for delegation.

Your you are the owner, and you are doing all of the invoicing and collections. You are so busy you frequently send out invoices late or forget to follow up with past due accounts. You would like to delegate invoicing, but aren’t sure how or who to delegate it to.

Year-end taxes don’t have to be painful.

Tax time is a burden that can weigh you down and drain your energy and passion towards your business. Not anymore.

Our team personalizes your reports and prepares documents for you to hand over to your tax accountant, making your filing experience as smooth and easy as possible. We also support you with state and local registrations and filings, and your 1099 filings. At Momentum, you can count on us to keep your numbers accurate and your business compliant.

Momentum Accounting is a new breed of outsourced accounting firm.

We are numbers-driven, tech-savvy and we see accounting solutions as an opportunity to transform accounting into an engine for growth and a source of competitive advantage.

The first step…a Momentum

Accounting Health Check.

Do you have issues with invoicing and receivables? Is it easy to find out who has paid and who hasn’t? What is your monthly burn rate? Are your gross margins within industry standards? We think it’s vital to have a handle on your financial well-being. So before we start building any solutions, we like to take the temperature and check the pulse on your financial performance.

Schedule an Accounting Health Check

We’ll create a single source of truth for all of your accounting functions.

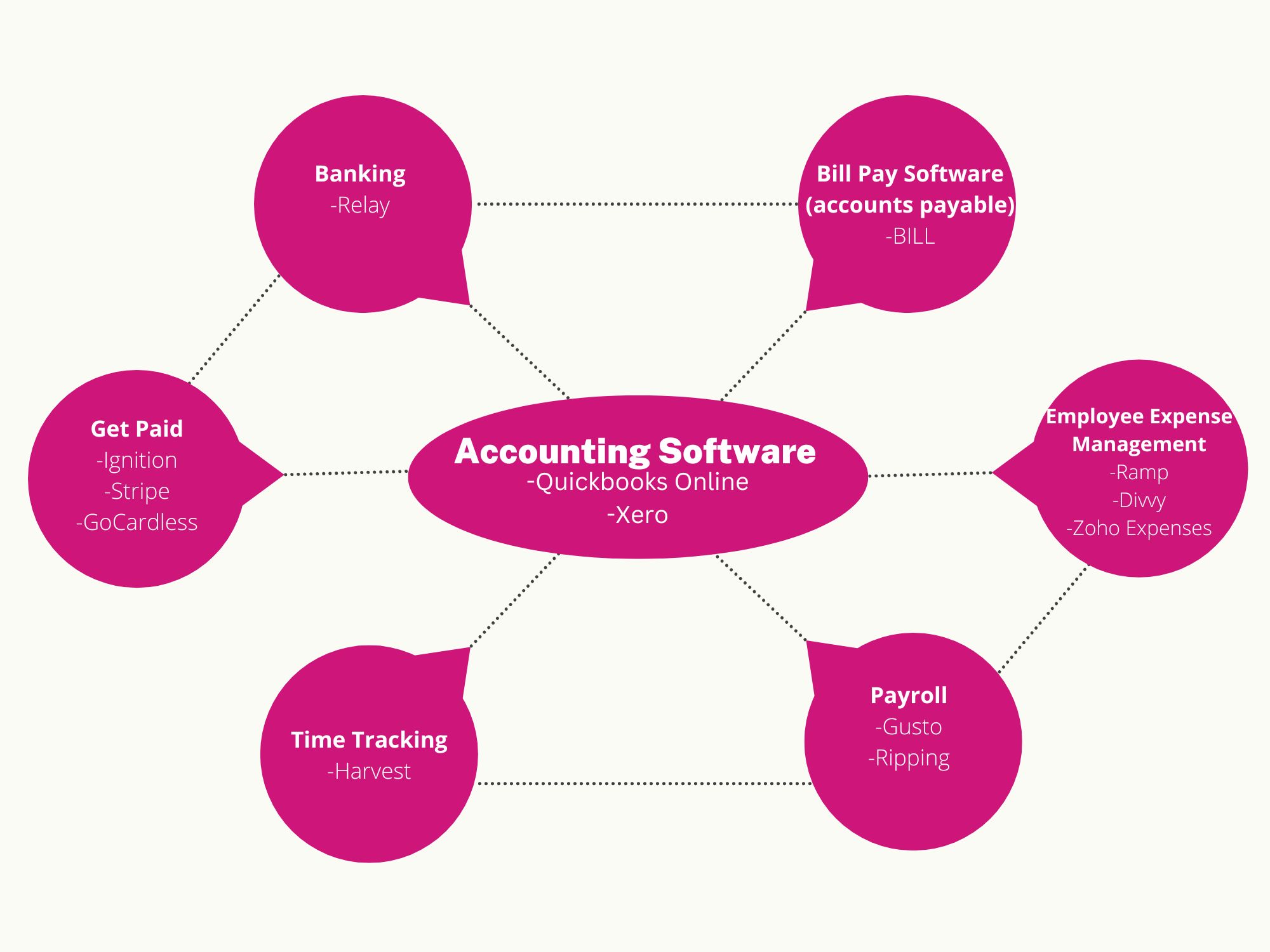

One of the biggest challenges for digital agency owners is that there are so many disparate systems being used – one for bookkeeping, one for invoicing, one for bill paying, one for tracking employee time, and another for payroll expenses. When questions come up, someone has to dig for the answers…and that’s not the best use of anyone’s time. We fix that.

An integrated system of accounting software and workflows.

Momentum is expert at building custom plug-and-play accounting tech stacks tailored to digital marketing agencies. We start with core accounting software — QuickBooks Online (QBO) or Xero (a Momentum favorite). This is the hub of your Momentum Solution. Then we go through all of the accounting functions and workflows and specify the best software tools for each.

Keeping the Momentum going with Strategic Advisory Insights

We monitor the data daily, perform weekly bank reconciliations, and provide a three-page Financial SmartShot report every month that includes a financial summary, profitability, and cash flow.

You have the monthly data you need to make strategic decisions around cash management, cash reserves, client concentration, etc. We also call your attention to outliers and anomalies, and provide recommendations based on what we learn month over month. It’s CFO level guidance without a CFO salary.

Run your business at full throttle and leave the books to us.

Accounting has always been high on the list of business functions to outsource. The key benefits of your Momentum solution:

1. Improved focus on your core business.

With Momentum on your side, you don’t waste time dealing with accounting issues – invoicing and collections, managing payroll, reconciling expense reports and bank statements, etc.

2. Access to expertise.

Momentum specializes in accounting and has the experience and expertise you need. That includes putting together a fully integrated tech-stack that streamlines and automates your accounting workflows.

3. Greater insight into financial performance.

From our initial Momentum Accounting Health Check to setting up your benchmarks KPIs (key performance indicators), you will have the data you need to make better decisions on a daily basis.

4. Cost reductions.

Your accounting department comes off the payroll (including benefits, health insurance, etc.).

5. Scalable growth.

Transform your accounting function from a an administrative task that always falls to the back burner to a proactive cash flow and cash management tool.

Support and Training

In addition to your single point of contact, you have a team of accounting experts in each area that your business needs. Regular zoom meetings and open communication will have you feeling confident, happy, and supported. If you are ever stuck or stalled, we’ll get you back up to speed as quickly as possible. Need to train a new hire on a specific workflow? Having a sync issue with one of the apps? We’re on it, pronto.

Get your digital marketing agency in high gear with Momentum.

We love accounting and it shows. You’ll love our people-first approach.

The combination of our savvy team, custom technology stacks, monthly reports and powerful analytics turn accounting data into actionable insights that drive real growth for your agency.

Stop juggling. Start focusing.

“If you need more (beyond just bookkeeping), then it’s a no brainer, they are awesome and they will be there as you grow.”