Cash flow is the lifeblood of every business. It’s the fuel that drives growth. When it sputters or stalls, it can put your entire enterprise at risk. In the agency world, there are a few reasons for cash flow issues:

- Not enough profits to sustain positive cash flow

- Not enough cash on hand to weather the ebbs and flows of large projects

- Ineffective invoicing and collections

Throughout this book you will find strategies and great ideas to deal with many issues affecting agency growth. This article deals with invoicing and collections and shows you how to transform it from a nuisance to a competitive advantage.

The old way…send an invoice and wait to get paid.

Most agencies push invoices out and wait to get paid. In fact, depending on the size of the agency and the clients they deal with, the average wait to get paid ranges from more than a month to up to 52 days! That creates an enormous strain on your cash flow because you have to float all of the expenses it takes to earn revenue.

Here are a few signs that your company is experiencing symptoms of ineffective invoicing and collection

Processes:

- You sometimes have to contribute money to the company or draw on a line of credit because you don’t have enough cash to cover payroll, even though your business is profitable on an annual basis. This should be a serious wake up call.

- The company’s Profit and Loss statement is “lumpy”; meaning the net profit takes big swings each month and it’s always a surprise. No one likes surprises, especially financial ones.

- When you look at your P&L, all your revenue is consolidated into one line item, so you have no insight into which clients and services are most profitable. Because of this, it’s hard to know how the company is performing and it’s difficult to compare the agency’s metrics against industry benchmarks.

- When it comes to knowing who owes the company money, there is no one source of truth. For example, you may be using one system for invoicing and collecting payments, and a different system for entering your bank data and reporting. Your AR aging may not match in each system and that can lead to lost revenue. Even worse, you sometimes follow up with clients, only to find out they’ve already paid.

- You are the agency owner, and you are doing all of the invoicing and collections. You are so busy that you frequently send out invoices late or forget to follow up with past-due accounts. You would like to delegate invoicing but aren’t sure how or who to delegate it to.

One of the biggest complaints we hear from agency owners is that they HATE dealing with invoicing and chasing past-due customers. It’s a time sponge and nuisance. If it is poorly managed, you can end up with thousands or even millions of dollars tied up in accounts receivables. And this cash is for work that has already been done, which means your employees and contractors have already been paid. Before you read on, stop and take a second to look at your accounts receivable aging report.

What is the balance? Imagine if you had that money in your bank account right now. What could you do with it? We show clients how to get paid first and fast. With today’s cloud-based tools for accounting, invoicing, and payment processing, you can automate the invoicing and collections process and virtually eliminate issues with receivables. The result is a more predictable and steady cash flow along with substantial operational cost savings. Also, you no longer have to waste your valuable time on administrative tasks, so you can focus on activities that grow your business and strengthen client relationships.

Here’s how:

- Use cloud-based accounting software.

We recommend QuickBooks Online (QBO) or Xero (we think Xero has a better invoicing workflow) to automate invoice creation and send invoices electronically. These tools integrate with electronic payment options to allow customers to pay by ACH or Credit Card. These systems also have auto reminders that will send out emails to past due customers. - Use payment processors to pull payments.

The key here is to get your clients’ authorization to autocharge them right when they are onboard. Once you have a client’s bank or credit card info, you are in control. You can pull money from your clients’ bank accounts BEFORE you pay your expenses. The workflow is simple. Your client signs a contract electronically, then they are taken to a URL where they sign an ACH or credit card authorization (we prefer ACH since people can go back and contest credit card charges). Then the first invoice is created in QBO or Xero payment is processed right away. On the first of each month, you set your accounting software to autogenerate each invoice, which in turn triggers the payment processor to pull payment. Most processors take up to seven days for the cash to clear. But just imagine…on the 7th of each month, all your revenue is in your bank account, you have $0 in receivables… and you don’t even have to pay your first payroll until the 15th. Even if you are billing based on time and materials or project milestones, you can still auto-charge the customer for the hourly invoices. Best practice for this is to send out the invoice and notify the client that it will be automatically charged in one week so they can discuss any issues with the invoice before the charge occurs. - Delegate invoicing and collections.

Establish procedures and metrics for invoicing and receivables, and delegate it to an administrative or operations person. This is a very important role in your organization (after all, this is now your chief cash flow manager). This person will manage and monitor contracts, terms, payment processors, invoicing, and collections. They will create a master spreadsheet with automatically charged in one week so they can discuss any issues with the invoice before the charge occurs. - Get paid up front for project work.

If you work on projects, get paid upfront before each milestone rather than after. This is a game-changer. Imagine working on a project and before each phase, you take a payment from a customer. This means you get paid FIRST and then you pay your employees and contractors SECOND. - Bill more frequently.

If you work with a company that will not pay up front or allow you to automatically charge them (this is common with larger companies), you can ask to bill them more frequently—for example weekly or on the 15th and last of each month instead of just monthly. Always ask for better terms! Ask ask ask. - Incorporating cancellation clauses.

You should always require your customer to give you some pre-set amount of notice if they want to cancel their contract (i.e 30, 60 or 90 days). The larger the contract the longer the cancellation notice should be. Why? Because you’ve reserved that capacity for them. If they cancel, you’ll have time to replace that revenue. And by all means, stop services for nonpayment. If a customer does not pay in a timely fashion, you can stop services or hold back the deliverables. - Outsource accounting.

The old ways of pushing out invoices and waiting to be paid are no longer adequate. New technology and new processes enable agencies to have greater control over cash flow and greater insight into their financial performance. Your accounting partner will help you set up an integrated technology stack, create invoice templates that are mapped to your services and help you develop Key Performance Indicators…giving you real time insights into your company’s performance.

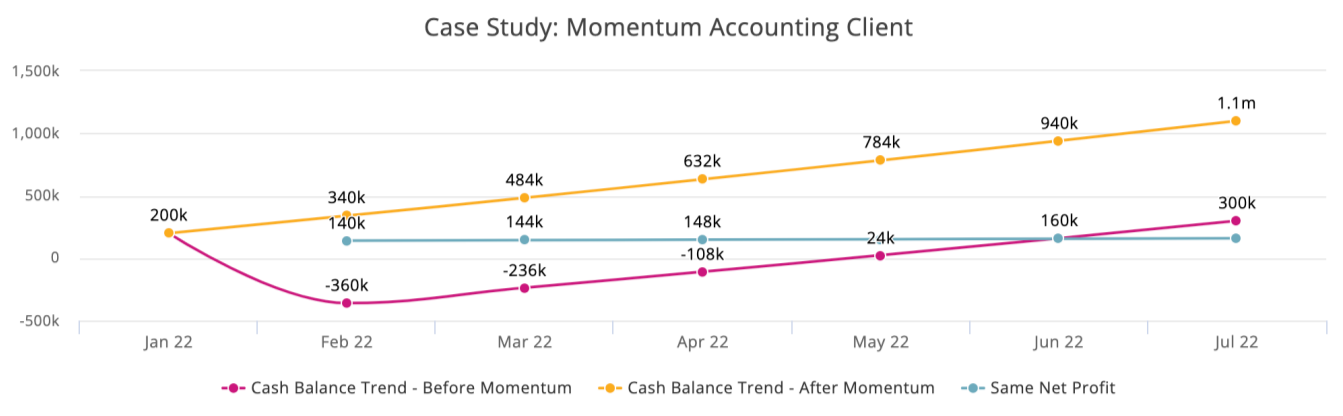

How we boosted cash flow for our client by $1,028,000

Here’s what can happen when you flip the script on cash flow.

Situation:

Our client had let their accounts receivable get out of hand. They had to hire a full-time AR person and a part time CFO to help manage cash. Even though they have substantial recurring revenue ($10M annually), they mostly accepted checks. They rarely accepted credit cards because they didn’t want to pay fees, which is understandable since 3% on $10M is $300k in fees per year. Their average AR balance was around $800k, and they had a large line of credit balance to float the cash tied up in AR. They were using QuickBooks Desktop, so there was no transparency into their financial data

Solution:

Over the period of a year, we converted their books to a cloud based accounting system, Xero, and worked with their operation manager to get their customers to agree to have their payments pulled using an ACH payment processor software.

Now invoices are automatically generated in Xero each week, then funds are pulled from customers’ bank accounts and deposited into our client’s bank account seven days later. Then the invoice is immediately closed out by the accounting system and reconciled against the bank transaction.

Results:

AR/collection position eliminated: +$65,000

CFO reduced 12 hrs p/m managing cash: +$40,000

LOC paid off, annual interest: +$48,000

Credit card fees eliminated: +$75,000

ACH fees added: -$6,000

Outstanding AR collected +$800,000

Total increase in Cash Flow: +1,028,000

Owner getting paid first and not having to stress if they will make payroll each week: PRICELESS!

If you’re an agency owner and want to turn your invoicing and collections into a competitive advantage, let’s talk.

Image: Below is a graph showing the cash balance trend of this company before we helped them fix their invoicing and collections process. We reversed the order of cash inflows and outflows.

In this example, the net profit is exactly the same, but the amount of money in the bank is hundreds of thousands of dollars more each month. The owners used the cash infusion to take distributions and purchased an investment real estate property that will appreciate over time. Much better use of capital than sitting in their customer’s bank accounts.