Next-gen Outsourced Accounting Solutions that deliver measurable results.

When you outsource your accounting to Momentum, you can be assured of three things:

- It will be in the cloud

- It will be accrual based

- It will be a source of sustainable competitive advantage

Here’s why Momentum does accounting in the cloud.

We’re numbers people first and foremost, but make no mistake, being tech savvy is our secret sauce. That’s why we love cloud accounting.

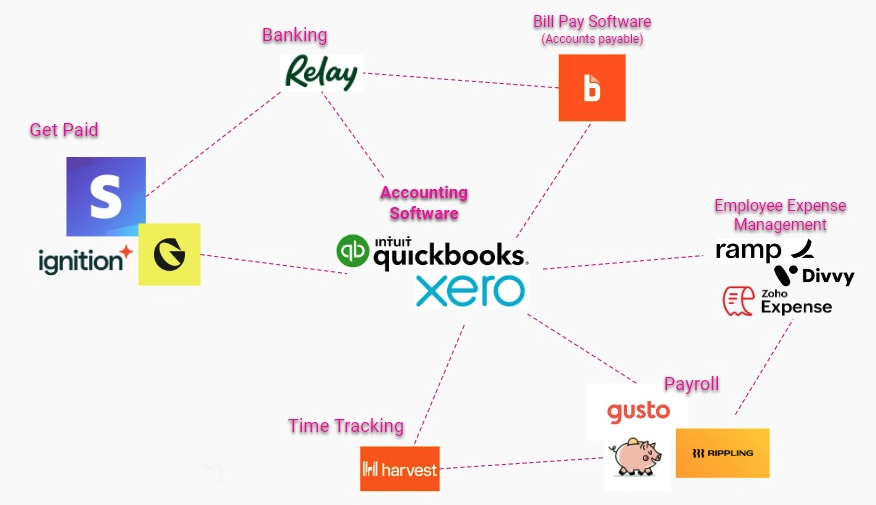

In the cloud, it’s now possible to build end-to-end digital, automated accounting workflows customized to your specific business. All of those workflows can then be synced and integrated into your QuickBooks Online or Xero Accounting Hub.

Much like other cloud software, these solutions give businesses game-changing flexibility while reducing capital expenditures and maximizing human resources.

And the best part is, once they are built and integrated, you don’t even have to run them. Momentum Accounting does it all in the background for you.

Real-time financial information at your fingertips.

What used to be labor intensive administrative tasks – running payroll, reconciling bank statements and expense reports and getting everything posted properly to the general ledger – are now off your plate, completely.

Even better, the information you need to make sound financial decisions is just a click away, accessible from anywhere you can get a signal. Need to check AR aging? Want to pay some bills? How are gross revenues this month? Questions that used to take hours/days/weeks to get answers are now available immediately and are served up in a user-friendly app that puts you firmly in control of your financial information.

Simple, streamlined reporting

Dashboards for easy access

Bookkeeping

Automatic Bill Pay (accounts payable)

Automatic Invoicing (accounts receivable)

Automatic bank feeds

Real-time financial data

Financial reporting on an accrual basis

Organizing and going paperless: No more data entry. Receipts and paperwork will all be stored in the cloud

Unlimited access to your data on any device at any time

Freedom to make smart business decisions from anywhere

.

Want a deep dive on Cloud Accounting?

Click for more

What Is Cloud Accounting?

Cloud accounting refers to performing basic accounting tasks, like managing and balancing the books, using software that resides in the cloud and is often delivered in an as-a-service model. Momentum accountants manage accounts payable, accounts receivable, the general ledger and much more within the application.

Just like other cloud-based systems, cloud accounting software runs on a cloud provider’s platform rather than on a local hard drive or server. Owners and other credentialed employees can access the tools and information they need through the internet and do not need to be in a certain location to understand the financial state of the business.

How Cloud Accounting Works

The software is typically integrated with the company’s bank accounts, so all transactions automatically post to the correct digital ledger. Users have real-time access to the financial information most critical to their roles, like available cash, bills due in the next five days, or an aged receivables report. All numbers update immediately as the software receives new information, and owners can drill down into the data for additional details.

The Benefits of Cloud Accounting

Automation: When bank accounts are connected to the accounting system, transactions post automatically, meaning no time-consuming data entry or manual imports. This software can also automate account reconciliations, matching bank statements and invoices to ledgers to help you close the books more quickly. Some accounting applications can also automatically pay vendors and send invoices to customers on user-defined dates.

Accessibility: All anyone needs to access a cloud accounting solution is an internet connection, web browser and login credentials. They can access the solution on mobile devices like smartphones and tablets.

Lower overhead expenses: Organizations that outsource accounting to a firm using cloud technology often spend less than those who manage their tech stacks in-house. More than 60% of IT executives said reducing cost was their primary concern, according to cloud research firm Datometry. Much of those savings stem from the fact that you don’t need to purchase hardware or pay a large IT staff to manage the system. Avoiding upgrades and maintenance that often result in big bills from the vendor or a partner lower the total cost of ownership, as well.

Data security: The security protocols of top cloud software vendors are far more extensive than what most businesses can do on their own. Cloud providers regularly back up your data to servers in multiple locations, reducing the risk that a fire or natural disaster could compromise your instance of the system and information.

Scalability: Organizations can take advantage of just about any computing resources they might need with cloud software. As the business and its needs grow, they can add server space as they need it.

Increased collaboration: Cloud accounting software facilitates collaboration because all data is accessible and viewable to all authorized users. There is no single information gatekeeper, (a major fraud deterrent) so if a marketing leader, for instance, wants to see sales numbers from last quarter, their permissions can be changed to let them do so. Visibility encourages cross-departmental projects and teamwork.

Faster implementation: Companies can usually get up and running on a cloud solution faster because there are no servers to purchase and set up and no IT team to train. Additionally, top vendors have done thousands of implementations and have developed efficient, repeatable processes that will allow you to quickly reap the benefits of the new system.

Why we standardize on Accrual Accounting instead of cash-basis accounting.

There comes a time when a business outgrows cash-basis accounting. It’s typically when revenues approach or exceed $1 million on an upward trajectory. At that level, the complexity of accounting for the business expands as well.

How will you know? Critical accounting functions such as payroll, bill paying, invoicing and collecting become so time and labor intensive that they are a drain on productivity, prone to error, and potentially hurt the profitability of the business. And the financial information provided by cash-basis accounting provides no real insight into how the business is actually doing.

At Momentum we use accrual basis accounting to create a competitive advantage for you.

We move our clients from cash-basis to accrual basis for some very powerful reasons. It provides a more accurate picture of the company’s financial performance month to month. Accrual basis financials are the foundation for any KPI analysis or forecasting. They enable us to see trend lines, and detect any warning signs around income, cash flow, profitability, and margins.

It changes the way we record to the ledger and supports the matching principle – whereby companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month). As a result, we can help our clients better project revenues while tracking future liabilities.

And should your business ever need a line of credit, new investors, or a potential exit through sale, you will need to show them books that use the accrual method.

We give your business Momentum with outsourced, cloud-based, accrual accounting.

New technology and new processes enable our clients to have greater control over cash flow and greater insight into their financial performance. If you don’t know, you can’t fix it. We make sure you know so you can forecast more accurately, and make strategic adjustments based on real-time data.

More important, you can focus on things that really grow your business and strengthen client relationships, because you have Momentum on your team.

We put it all together for you so that your accounting services become a continual source of competitive advantage.

People focused. Technology driven.

“If you need more (beyond just bookkeeping), then it’s a no brainer, they are awesome and they will be there as you grow.”