Strategic Advisory Insights

With Momentum Accounting, your business has a next-gen automated, integrated cloud accounting system of systems. Nearly all of the administrative and clerical work has been taken off of your plate. We do the accounting in the background, and you are free to focus on growing your business.

We use Quickbooks Online (QBO) or Xero as a hub, we link and sync to all of the critical applications in the business accounting ecosystem – payroll, AR/AP, employee expense reporting, etc. Tasks that used to be time, labor, and paper intensive, are now running at computer clock speed with minimal human intervention.

That’s important, because that allows us to spend significantly more time analyzing your results and providing valuable insights, month after month.

Your Monthly Momentum Financial SmartShot™

Every month, we will provide a Financial SmartShot™ (it’s like a financial snapshot, only smarter) that provides a focused look at the metrics that matter..

This three-page report is your single source of truth for all your accounting and financial performance data. And it is presented in a way that helps you gain greater knowledge about what is working and what isn’t.

Net profit is down this month. Why? Were there unexpected expenses? New hires that took time to get fully on-boarded and engaged? We know what questions to ask and where to look to find the answers.

We provide expert commentary on the results, highlighting variances, raising flags, understanding the outliers. Every month, our accounting experts make recommendations about how to keep or get things moving in the right direction.

Momentum Accounting Financial SmartShot Glossary

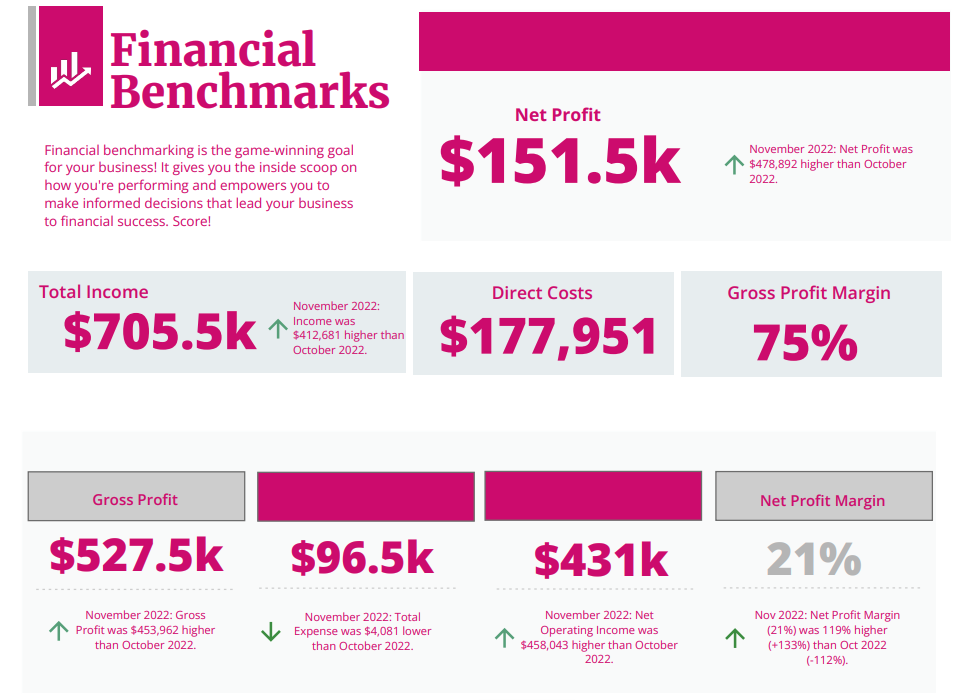

Net Profit

The single most important indicator of financial performance. Are you making money, month over month?

Total Income

How much revenue did you generate? Is it growing? If not, do you know why?

Direct Costs

How much does it cost to make and deliver the things you sell or the services you provide? Cost of goods sold (COGS) is interchangeable with direct costs.

Gross Profit

Total revenue minus direct costs equal gross profit.

Gross Profit Margin

What you sold minus what it cost to make it is expressed as a percentage. Healthy gross profit margins are the foundation of a successful business.

Overhead Costs

Overhead costs can include fixed monthly and annual expenses such as rent, salaries and insurance or variable costs such as advertising expenses that can vary month-on-month based on the level of business activity.

Net Operating Income

A measure of profitability which represents the amount the company has earned from its core operations. It is calculated by deducting operating expenses from operating revenue. It excludes non-operating expenses such as loss on sale of a capital asset, interest, tax expenses etc.

Net Profit Margin

Net profit margin is one of the most important indicators of a company’s overall financial health.

Net profit margin helps owners understand if their company is generating enough profit from its sales and whether operating costs and overhead costs are under control.

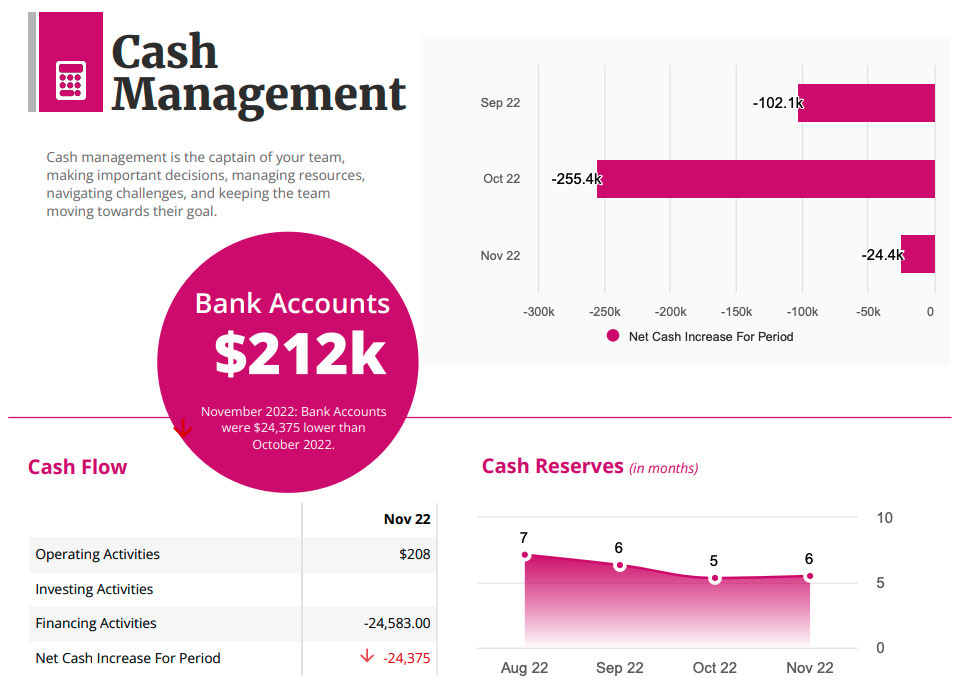

Cash Management

Cash management is the process that involves collecting and managing cash flows from the operating, investing, and financing activities of a company. It is a key indicator of an organization’s financial stability.

Bank Accounts

The total available cash to fund operations without having to draw on lines of credit or capital markets.

Cash Flow

The lifeblood of a business, cash flow refers to the net amount of cash and cash equivalents being transferred in and out of a company. Cash received represents inflows, while money spent represents outflows.

Cash Reserves

Emergency funds set aside to fund operations through downturns in business. In the world of startups this is often called runway. How many months can you fund operations if there was no revenue?

Build your business with better numbers.

“If you need more (beyond just bookkeeping), then it’s a no brainer, they are awesome and they will be there as you grow.”