Is your business gaining the benefits available from automated bookkeeping?

Bookkeeping equals a chore in your mind, right?

Keeping up with transactions and expenses is a needful process in any fundamentally-strong business. But too many think of it as a reactive game we play. Many more wait until the new fiscal year to even look at it (or hand it off to a qualified accountant).

What if your bookkeeping could do two (relatively unexpected) things?

- Get done automatically

- Help you make better decisions

It can, here’s the rundown on how to do it.

First Off, “Automated Bookkeeping”?

We live in the age of bots, and many of them come in the form of financial tools. “Fintech” is an entire industry that presses the envelope of algorithmic intelligence.

If you have a credit card that automatically categorizes expenses, you’re seeing the advent of this technology firsthand. Automated bookkeeping is as it sounds; use tech to categorize expenses, reconcile transactions, and generate reports — with minimal (or zero) human interaction.

Obviously, a qualified real person reviewing these reports is a good idea. Now, onto the benefits.

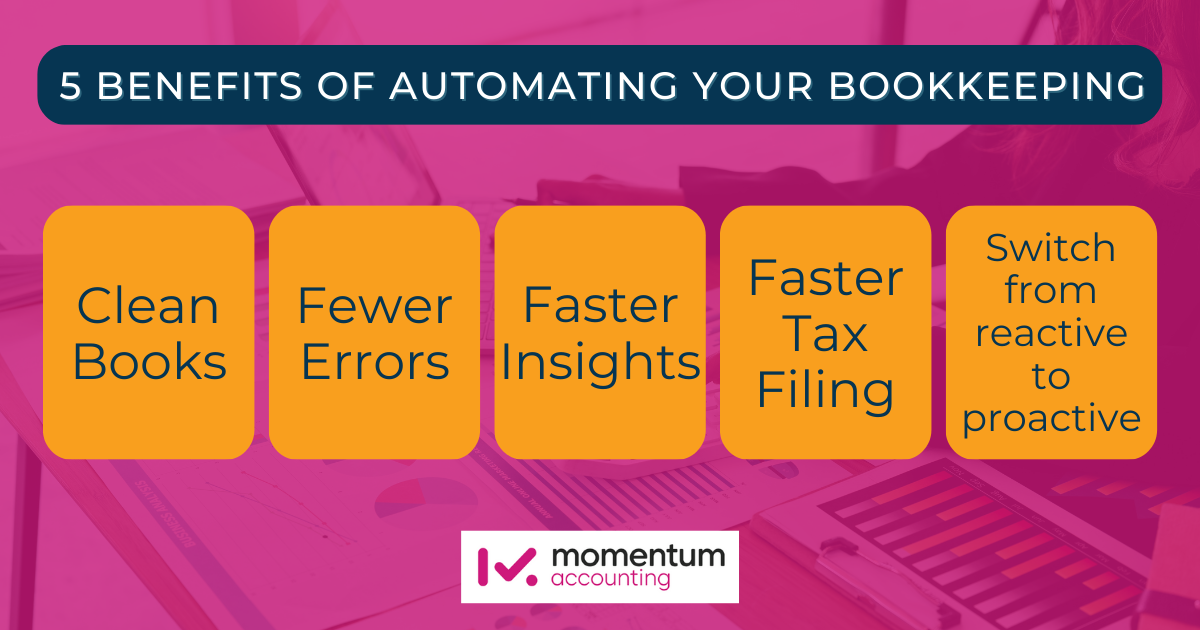

5 Benefits of Automating Your Bookkeeping

- Clean books (obviously): Let’s get the obvious out of the way. Say this to yourself, “My books are clean.” Sounds good, right? That’s exactly what you’ll have all the time, if you automate bookkeeping.

- Fewer errors: Robots are consistent, and become more efficient over time. For instance, if there is a new type of expense and you categorize it, most programs will automatically categorize all similar expenses, going forward. And that’s just a single example.

- Faster insights: Instead of getting your statements and financial reports infrequently, automated bookkeeping solutions are as consistent as a well-tuned clock. If you regularly review things like your P&L (which you should), you’ll get tons of insights from the real-time nature of your automated books.

- Faster tax filing: If your fiscal year ends on December 31st, wouldn’t it be nice to have all the tax data ready by January 1st? If it were only up to your bookkeeping, you’d be ready.

- Switch from reactive to proactive: Your business’ financial data are tools that drive necessary decisions for your company. If you have access to real-time data (including expenses, cash flow, etc.) looking over this data is no longer a hassle, but a useful resource.

Ok, so how do you get started? First, there are a few things to remember.

3 Automated Bookkeeping Considerations

Before you automate bookkeeping in your organization:

- It’s slow-moving magic: AI and Machine Learning take time to hone to your exact needs. Take that example of expense categorization (among other things). It takes several months of really honing things down until you really get to the “aha!” of automated bookkeeping.

- It’s a tool: Automated bookkeeping is a tool, like manual bookkeeping is a service. An important part? Yep. A full accounting and/or cash management system? Hard no.

- Humans still needed: As alluded to in the last point, a full accounting system needs things bots don’t have. Things like; experience (both in their own career, and the experience helping other clients), strategy, and communication.

How to Harness Its Power

The power of automated bookkeeping is there, for the taking. However, like any other form of power, it takes infrastructure, planning, and someone who understands how that power works.

This is where an accounting partner comes into play.

An accountant who utilizes technology to aid clients is becoming common. That said, you want a partner that truly understands how automated bookkeeping provides immense value to them and your business.

A good partner:

- Connects everything together: Tech implementation is really important. Connecting expense management, payroll, bookkeeping, and other tools together (via integrations) is something of a specialized skill.

- Sees the insights: Not only does the right partner make your automation better over time, they understand what the data is telling you, pointing out those insights along the way — empowering you toward better decisions.

- Advises based on the data: Beyond data, a great accounting solution provides CFO-level suggestions that further your ability to set clear direction and meet your objectives.

In short: Harnessing the power of automation means connecting quality tools to a qualified human touch.

Gain Momentum Through Automation

At Momentum, we understand the need for tech and have an entire tech implementation service, along with all the other qualifications to set up your automated bookkeeping system.

We’re also there, offering the insights and advice you need to fully use your proactive accounting system to better your business. Ready to find your Momentum? Get in touch with us today.